There is something you need to know about investing, it has one BIG problem. Now, as part of a financial services institution that deals with investing, you would think that we would rather keep our cons in the closet while proclaiming our pros from the rooftops; but you should know that Dalex SWIFT does things differently. We are more focused on you and the value you get from investing with us than we are on ourselves.

Before we dive deep into what the actual problem with investing is, it would be good for us to get a little bit of context about where this “confession” of ours is coming from…

Get-rich-quick schemes – and scams – have one thing going for them; they can get you money that comes in faster and hotter than Sister Akos’s fried yam and shitor on a Friday evening. However, “fast and hot” is usually also the same way in which all the trouble that these attempts at making quick money can bring, soon follow: #NAM1, #FraudBoysnGirls, #YouDoYawa. Let’s be real here, money isn’t just printed paper or little collectible circles of metal. It is the tangible proof of ideas that better lives, and the day-after-day commitment of people to providing for themselves and others. Money matters! Because of how important money is, how we make it and the price we’re willing to pay for it matters too. So, we need to ask ourselves: Is “quick” really worth the cost when it comes to making money?

Now to the elephant in the room, the problem with investing is that it doesn’t work as a quick fix…but that’s actually not a problem. When you invest with Dalex SWIFT, it’s just a matter of time. Literally.

Your Dalex SWIFT investment uses the reliable power of compounding interest to grow your money – the interest earned on your principal balance is reinvested and generates additional interest. For instance, if an initial investment of GHS 1,000 earns 10% interest (our rates are higher 😉), at the end of year one you would have GHS1,100, assuming you don’t add anything to that during the year. For year two, the balance still earns 10% interest, giving you GHS1,210… get it? Benjamin Franklin put compounding interest this way: “Money makes money. And the money that money makes, makes money.”

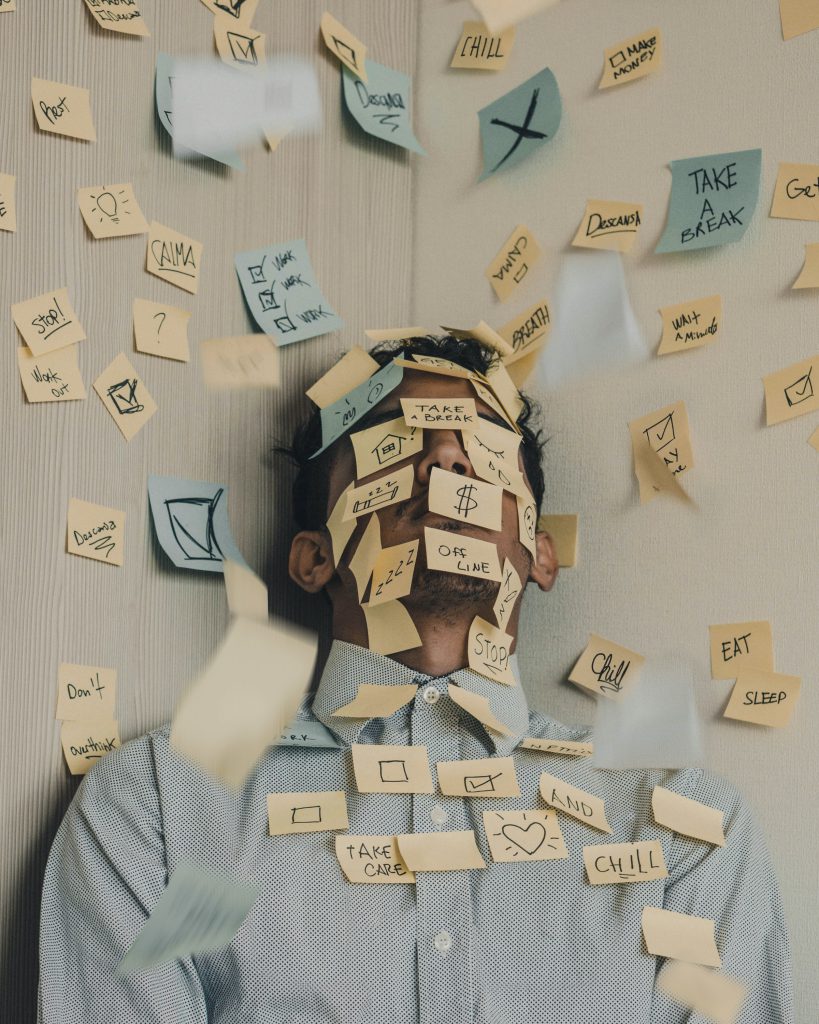

So, with Dalex SWIFT, as long as your investment is paying you interest, there’s no need for fraud or quick fixes. You can #RestEasy because with us time is actually your friend when it comes to making money.

Finally, in celebration of the fact that there actually is no “problem” when it comes to investing with Dalex SWIFT, why not just start?